To calculate a back pay amount for a non-salary employee, see Calculating back pay for an employee

Select the Main sub menu.

|

Select the Further Entry & Calculate option.

|

Select the New option in the toolbar.

|

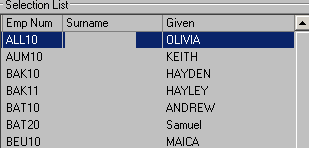

Select the required employee from the list.

|

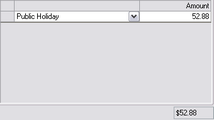

Select the Add Row button in the Incomes / Allowances list.

|

Verify the amount entered matches your banking records. It cannot be changed once the payroll run is complete. |

Set Payment Type to Cheque. This indicates that payment for this back pay has been / will be arranged outside of normal electronic banking payments.

|

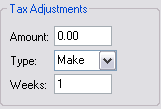

Normally back pay is an additional payment on top of an employee's normal payment for a given pay period in the past, however back pay may sometimes represent the entirety of an employee's pay for a given pay period in the past (ie. the employee was not paid at all for a given period). Depending on the circumstances of the back pay, you will need to review the standard allowances / deductions and tax calculations for this payment. If the back pay only represents a partial missed payment then standard allowances and deductions should be removed from this payment (as they will have already been applied to the employee's original payment for that period) and a Make type tax adjustment of $0.00 should be set as below.

If the back pay represents a payment missed entirely for a given pay period then standard allowances, deductions and tax calculations should apply. |

Select the Save option in the toolbar.

|

? |

If you are uncertain about any aspect of this process then contact Abcom Support for more information. |