Step 1 - Set up a salary sacrifice income type

It is best practice to make a separate income type for each different type of Salary Sacrifice (e.g. Salary Sacrifice Car, Salary Sacrifice Laptop, Novated Lease etc.). If you have already set up the required salary sacrifice income types then proceed directly to Step 2 - Setting up an Employee Record to deduct a salary sacrifice Please note that an allowance income type for Salary Sacrifice Superannuation will already be set up in your payroll system so there is no need to add another. |

Select the Setup sub menu.

|

Select the Income Types option.

|

Select the New option in the toolbar.

|

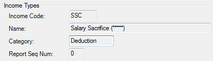

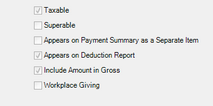

Enter an Income Code and Name for the income type and set the Category to "Deduction". Note that the Income Code must be unique. Report Seq Num may be left as 0. |

Select the Save option in the toolbar.

|

Step 2 - Setting up an Employee Record to deduct a salary sacrifice

Select the Main sub menu.

|

Select the Maintain Employees option.

|

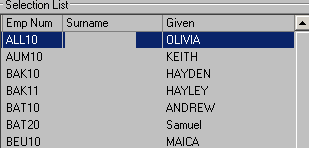

Select the required employee from the list on the left.

|

Select the Edit option in the toolbar.

|

Select Add Row in the Standard Weekly Deductions list.

|

Select the required Salary Sacrifice income type and enter the monetary amount for the deduction.

|

Select the Save option in the toolbar

|

When processing payroll for the first time after setting up a Salary Sacrifice, be sure to check that employee’s pay slip to confirm that the Salary Sacrifice set up is correct. |