Select the Main sub menu.

|

Select the Maintain Employees option.

|

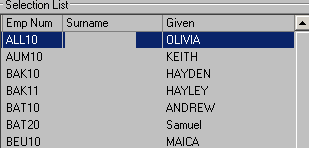

Select the required employee from the list.

|

Select the Edit option in the toolbar.

|

Select the Pay Details tab. |

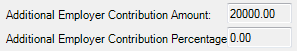

Enter the additional contribution to be made either as a fixed amount in the Additional Employer Contribution Amount field or as a percentage of employee gross payment in the Additional Employer Contribution Percentage field.

|

Additional employer super contributions are be calculated and applied each time a payslip is generated for this employee. If a payslip is not generated (i.e. no payment is required for an employee in a given payroll run) then the additional employer contribution will not be made. You can verify a contribution has been applied with super reporting and under the Reportable employer superannuation contributions entry on the employee payment summary. |

If this is a one off contribution it must be removed from the employee before processing the payroll for the following week. |